The Oxford dictionary definition of the verb “endure” has two meanings:

1) to suffer (something painful or difficult) patiently; and

2) to remain in existence; to last.

For valuation-centric investors, these definitions are inextricably linked. During euphoric, momentum-driven markets such as we’ve experienced recently where valuations are historically expensive1, valuation-centric investors must be willing to think and stand independently from the crowd. This is difficult at times, especially as expensive securities that do not meet our investment criteria are bid higher on a seemingly daily basis. At VELA, we seek to buy durable businesses with strong long-term prospects trading at significant discounts to our estimates of intrinsic value. We prefer these businesses to have strong balance sheets and for them to be run by talented, owner-oriented management teams. We believe that this is an enduring investment philosophy that will enable VELA to produce strong investment returns for our clients over the long term.

The goal of this piece is to explore 1) the current investment landscape in U.S. equities; and 2) the focus of the VELA investment team and where we are finding investment opportunities.

The Current Investment Landscape in U.S. Equities

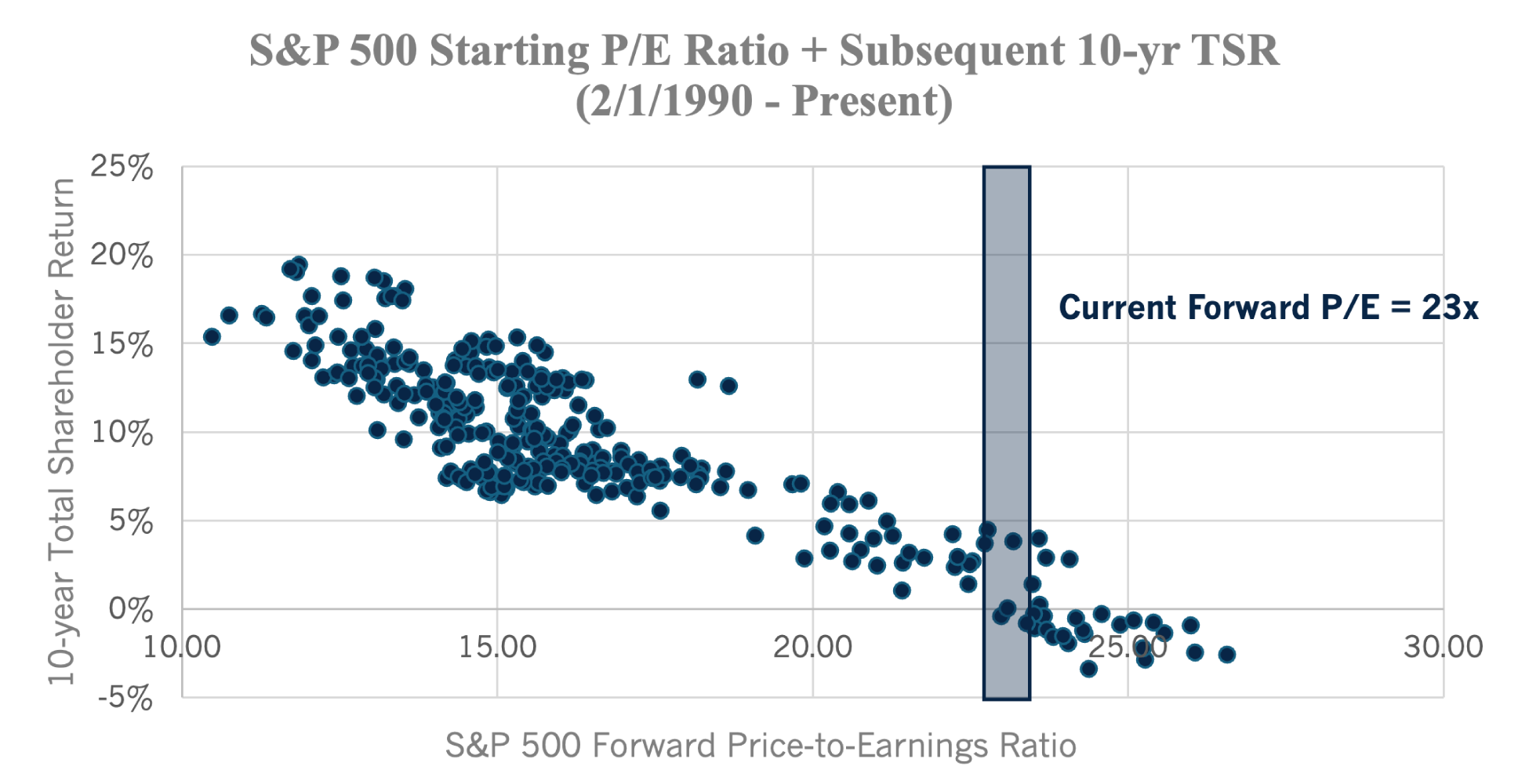

The S&P 500 index is historically expensive by just about any statistical measure1. Large cap growth stocks have driven above-average investment returns over the past 10 years, propelled by strong earnings growth but also significant multiple expansion2. The current forward price-to-earnings multiple on the S&P 500 index, at nearly 23x, is near record levels last seen in the Dot-Com era and, as shown on the graph below, historically is consistent with subsequent 10-year forward investment returns that are significantly below long-term averages3. In other words, unless “this time is different”, S&P 500 index investors should prepare for below-average long-term returns over the next 10 years.

While the Magnificent Seven and artificial intelligence garner a lot of focus and attention these days, less technology-intensive businesses, such as Costco (COST), are also historically expensive and trade at valuation levels at or above where they traded during the Dot-Com era (52x forward price-to-earnings vs ~36x Dot-Com Peak)4. Both the S&P 500 and Costco experienced disappointing investment returns over the subsequent 5 and 10-year periods5. While Costco meets nearly all of our non-valuation investment criteria and remains on our “watch list” of companies we’d like to own at the right price, we simply cannot make the math work from a valuation standpoint. Many businesses sharing similar business strengths as Costco on our watch list remain far from meeting our valuation criteria. Experience in following these businesses over long periods of time tells us that we’ll likely have a chance to own many of them at attractive prices at some point over the next five years.

To summarize: first, the bad news. Broader market, large capitalization indices today are trading near Dot-Com valuation levels, from which subsequent 10-year returns were disappointing. Is this time different given the prospects of artificial intelligence? We suspect not.

Now, let’s get on to the good news!

- VELA, as an active investment manager, manages portfolios that look significantly different than the indices.

- The period following the Dot-Com era was favorable for valuation-centric investors We believe the same will be true when conditions normalize.

- Even in a relatively expensive environment, our investment team continues to find strong businesses trading at valuations we find attractive in both domestic and international markets.

The Focus of the VELA Investment Team and Where We Are Finding Opportunities

At VELA, we have a highly skilled, motivated, and experienced investment team. While we cannot control when the euphoria we observe in markets today will subside, we are squarely focused on what we can control. Each member of our investment team closely covers businesses and industries we consider attractive so that we are prepared when investment opportunities arise. Oftentimes these opportunities present themselves because a business or industry is experiencing some sort of cyclical or near-term headwind, while we have reason to believe that long-term business fundamentals will be just fine. While investment firms with a shorter time horizon may be unwilling to look past short-term fundamental weakness, our minimum five-year investment horizon provides us with a different lens. We believe that the practice of buying quality businesses at attractive prices and allowing time for fundamentals to improve will more likely lead to favorable, consistent risk-adjusted returns over the long term, compared to our more near-sighted counterparts. In other instances, certain areas of the market are persistently underfollowed or ignored, providing our investment team the ability to buy attractive businesses at favorable valuations. While not exhaustive, below are examples of where VELA’s investment team has recently found what we believe to be attractive investment ideas.

- Industrials – The United States has been in the longest freight and manufacturing recession in decades, with many businesses earning well below their normalized, mid-cycle earnings power7. While this makes them unattractive to many short term investors, it has enabled our team to build meaningful positions across the VELA strategies in a variety of industrial and transportation businesses that possess strong balance sheets and competitive advantages vs. their peers. We have followed several of these businesses and management teams for decades, providing us the conviction to act meaningfully when opportunities have presented themselves. A recent addition is Lincoln Electric (LECO), while longer-term holdings of meaningful size include Hub Group (HUBG), Kirby Corporation (KEX), and Applied Industrial Technologies (AIT).

- Small Cap Companies – Small cap businesses currently trade at significantly more attractive valuations than their large cap peers, despite many of them having similar characteristics9. Many of these businesses have less analyst coverage than U.S. large cap companies, and in some instances very little to no analyst coverage.

Thoughts on the Last Nearly Five Years and the Next Five Years

I joined the VELA investment team nearly five years ago as Director of Research. I am tremendously proud of our team. We are building experience with our group of talented Research Associates, while we are leveraging the collective experience of our Portfolio Manager Research Analysts. We have worked, and will continue to work, tirelessly to uncover attractive investment ideas.

Over the past several years, Mr. Market (using the Benjamin Graham analogy) has become increasingly enamored by quality large cap growth businesses, with no price seemingly too high for many of these companies. The VELA investment team has stayed true to the “V” in VELA, which stands for valuation-centric investing. While we seek to find quality businesses with strong business prospects and solid competitive advantages, we will not pay a price above what we believe the business is worth. In this environment of stretched valuations across large subsets of the market, we are encouraged that we continue to find businesses possessing these characteristics trading at discounts to our estimates of intrinsic value.

Since the firm’s inception, we have seen pandemic shutdowns and re-openings, supply chain constraints and shortages, the war in Ukraine, inflation, a rapid rise in interest rates, a regional banking crisis, exuberance surrounding the prospects of artificial intelligence technology, war in the Middle East, and a heated Presidential election. While we do not know what additional challenges the next five years will bring, we strive to invest in companies that are resilient and can emerge stronger coming out of adverse environments through advantages such as balance sheet strength, competitive positioning, and opportunistic capital allocation. We have endured these challenges and believe we have built a strong and enduring investment firm on bedrock, valuation-centric investing principles. Looking ahead, we continue to believe that the combination of business quality and attractive valuation of companies across the VELA strategies provide us a good chance to outperform over the next five years.

Bobby Murphy serves as VELA’s Director of Research, as well as a Portfolio Manager on the All Cap Concentrated, Large Cap/Large Cap Plus, and Income Opportunities Strategies. VELA Investment Management is a 100% employee-owned investment management firm committed to a valuation-centric philosophy, intensive research process, and collaborative team structure.

The views expressed are those of VELA Investment Management, LLC as of 11/25/24 and are subject to change.

These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. Third-party information in this report has been obtained from sources believed to be accurate; however, VELA makes no guarantee as to the accuracy or completeness of the information.

VELA Investment Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

LECO, KEX, HUBG, and AIT are held in accounts included in the VELA All Cap Concentrated composite as of the most recent quarter end, 09/30/24. As of the most recent quarter end, COST is not held in any VELA strategies. Holdings are subject to change at the Portfolio Managers’ discretion and without notice.

Intrinsic Value is a measure of what an asset is worth, arrived at by means of an objective calculation or complex financial model. Intrinsic value is different from the current market price of an asset. However, comparing it to that current price can give investors an idea of whether the asset is undervalued or overvalued.

Forward Price to Earnings (P/E) Ratio is a valuation metric that compares a company’s current stock price to its estimated future earnings per share (EPS), essentially indicating how much investors are paying for each dollar of projected future earnings

Magnificent Seven refers to a group of high-performing large capitalization companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

Footnotes

1,2Source: Factset

3Source: Bloomberg

4,5Source: Factset

6Source: Russell Investments

7Source: Freightwaves

8Source: Factset, Bloomberg

Data included is as of 11/11/2024.

Author

Bobby Murphy

Jun 16, 2020