Dear Clients & Friends,

I want to take a moment to mark the second anniversary of the VELA Funds (9/30/2022), and to share my appreciation for each of you, our clients, associates, and friends who have played such an integral part in the development of our organization thus far.

Now in our third year, I speak confidently on behalf of the VELA leadership team in stating that we are gratified by our progress in providing clients with value-added returns, and confident in the excellence and steadfastness of the team we have built. At the outset of our operation, and in many of the conversations we’ve had over the past two years, I shared with you my conviction that investment returns in this decade would be considerably less than the last, and our goal that VELA’s investment returns would exceed passive alternatives over the same time period. As we survey both our progress and the investment landscape today, I am more convicted in both.

Inflation remains the leading concern for investors, as central banks around the world raise short-term rates in an attempt to dampen consumer demand for goods and services, prices for which have risen considerably over the past year. Energy, in particular, continues to be a primary point of leverage and ongoing tension in NATO’s response to the invasion of Ukraine, also contributing to inflation. Our belief is that monetary tightening will continue for the remainder of the year at least, pushing short term treasury rates in the US to the 4-5% level. This pressures financial asset valuations: The average Price-to-Earnings (P/E) Ratio1 for the S&P 500 Index, a proxy for US equity markets, fell from above 20x at the start of 2022 to a current level of 17x, showing a decline in the perceived value of U.S. equities2. Share prices (P), have fallen more than 20% this year, driven in the short term by a few factors, including investor sentiment. Slowing economic activity reduces company revenue growth, and inflation can reduce profit margins, and thus the “E” (Earnings) may be lower as well.

Over the next few months, uncertainty over the outcomes of several pivotal events will likely add to present financial market volatility: With regard to the war, Ukraine’s battlefield victories provide a tenuous hope for Russian withdrawal in the foreseeable future. At the Chinese Communist Party National Congress beginning October 16th, President Xi is likely, but not certain to be re-elected to a third term. At the Fed’s next meeting November 2nd, the Federal Reserve will likely raise interest rates again. Finally, the US midterm elections November 8th may result in a Republican majority in the House of Representatives, which would likely curtail inflationary pressures related to fiscal stimulus.

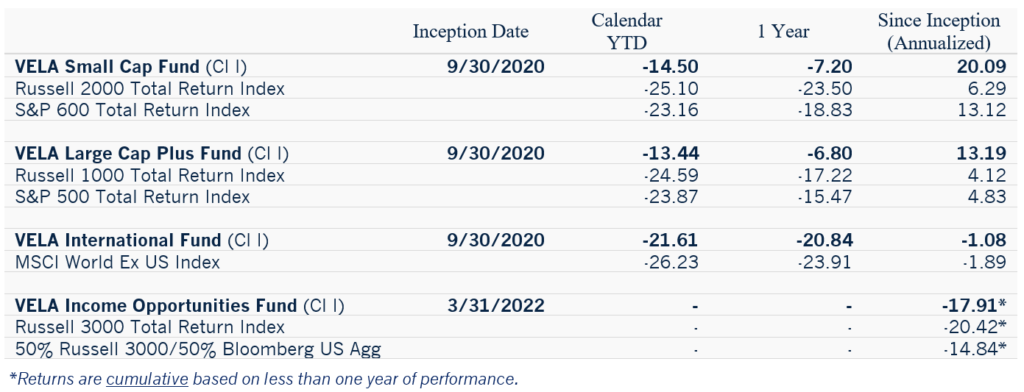

VELA Fund Returns (as of September 30, 2022)

Mutual fund performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Investors may obtain mutual fund performance data current to the most recent month-end by calling 833-399-1001.

The total expense ratio for the VELA Funds Class I is: Small Cap VESMX 1.19%; Large Cap Plus VELIX 1.84%; International VEITX 1.19%; Income Opportunities VIOIX 0.92%.

Over the past quarter, our team made trades to mitigate the impact of taxable investment gains incurred over the year and took the opportunity to reinforce positions in our highest-conviction ideas. In some cases, this has meant trading into new opportunities which we previously felt were too expensive relative to our estimate of value, and in others adding to established positions as we’ve seen the opportunity to buy at favorable prices. Operationally, we reviewed and made the decision to reduce the administrative fee for each of our mutual funds and associated share classes from an annual rate of 0.45% to 0.42%, effective as of the first date of this quarter (10/01/2022). As we’ve experienced economies of scale in line with the growth of our business, we felt it important to pass on the benefit to our investors.

We thank you for your support and partnership.

Sincerely,

Ric Dillon

Ric Dillon, CFA

CEO, CIO, & Co-Portfolio Manager

Ric Dillon is one of our firm’s founders and serves as Chief Executive Officer & Chief Investment Officer. Early in his career, Ric served as a Portfolio Manager for Loomis, Sayles & Company. During his tenure, the Detroit office became the top-ranking office in the company with the large cap and small cap value funds. The small cap fund that Ric started ranked number one in its Lipper category after its first twelve months of existence. While at Loomis, Ric created a new valuation model that Loomis adopted replacing the previous model of twenty-five years.

In the 1990s, Ric founded Dillon Capital Management, where he served as President and Chief Investment Officer until the company was acquired by Loomis, Sayles & Company, where he returned to work as a Portfolio Manager. In 2000 Ric founded Diamond Hill Investments, a public company (DHIL) based in Columbus, Ohio. During Ric’s tenure as CEO of the Company, Diamond Hill ranked in the top 1% of all public companies in the US in terms of shareholder total return, with an annualized total return of 27%.

Ric holds the Chartered Financial Analyst (CFA) designation. He received an MBA from the University of Dayton, as well as a M.A. in Finance and a B.S. in Business Administration from The Ohio State University.

Ric, his wife Marina and their daughter Luisa split time between homes in New Albany, Ohio and Orlando, Florida.

Investors should carefully consider the investment objectives, risks, and charges and expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 833-399-1001.

Important Information:

The Russell 2000 Index is a small-cap stock market index of the smallest 2000 stocks in the Russell 3000 Index. The S&P Small Cap 600 Index is a stock market index established by Standard & Poor’s. It covers roughly the small-cap range of American stocks, using a capitalization-weighted index. Prior to 3/1/22, the Small Cap Fund compared its performance only against the S&P Small Cap 600 Index. VELA believes the Russell 2000 Index is a more appropriate and accurate index against which to compare the Small Cap Fund’s investment strategy and, therefore, the Russell 2000 Index replaces the S&P 600 Index as the Small Cap Fund’s primary benchmark as of 3/1/22.

The Russell 1000 Index is an unmanaged market capitalization-weighted index comprised of the largest 1,000 companies by market capitalization in the Russell 3000 Index, which is comprised of the 3,000 largest U.S. companies by total market capitalization. The S&P 500 Index is a composite of 500 of the largest companies in the United States. The S&P 500 Index is unmanaged and does not represent the performance of any particular investment. Prior to 5/1/2022, the Large Cap Plus Fund compared its performance only against the S&P 500 Index. VELA believes the Russell 1000 Index is a more appropriate and accurate index against which to compare the Large Cap Plus Fund’s investment strategies and, therefore, the Russell 1000 Index replaced the S&P 500 Index as the Large Cap Plus Fund’s primary benchmark as of 5/1/2022

The MSCI World ex US Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries excluding the United States.

The Russell 3000 Index is a market-capitalization-weighted equity index. The index tracks the performance of the 3,000 largest U.S.-traded stocks, which collectively account for roughly 97% of all U.S.-incorporated equities. The secondary index for the fund is a blend of the Russell 3000 TR (50%) and The Bloomberg Aggregate Bond Index (50%). The Bloomberg Aggregate Bond Index broadly tracks the performance of the U.S. investment-grade bond market. The index is composed of investment-grade government and corporate bonds.

You cannot invest directly in an index.

The VELA Funds are distributed by Ultimus Fund Distributors, LLC. (Member FINRA)

VELA Investment Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

The views expressed are those of VELA Investment Management, LLC as of 10/06/2022 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. Third-party information in this report has been obtained from sources believed to be accurate; however, VELA makes no guarantee as to the accuracy or completeness of the information.

Control #: 15738389-UFD-10/4/2022

Footnotes:

1Price to Earnings (P/E) Ratio: The price to earnings ratio is a ratio for estimating the value of a company by measuring the market price for a security relative to its’ earnings per share. A high P/E ratio could mean that a company’s stock is overvalued, or that investors are expecting high growth rates in the future.

2Source: Factset